Xapien for financial services

‘Xapien's 10-minute reports empower rapid decision-making.’

Head of Compliance, leading private equity firm

Trusted by private equity firms, wealth managers, and insurers to accelerate decisions, protect reputation and unlock growth.

Organisations getting ahead with Xapien

The challenge

How manual due diligence holds you back

Whether you’re closing a deal, onboarding a new client, or underwriting a policy, manual processes slow you down. Legacy processes:

- Stall deals, when manual due diligence and AML checks create bottlenecks.

- Are plagued by false-positives, drain analyst resources, and waste company/client time.

- Won’t scale effectively as you grow.

- Miss nuance, exposing firms to reputational risk.

- Firms need speed, depth, and confidence in every decision. Xapien unlocks growth by solving the compromise between agility and rigour.

Speed meets certainty

Remove barriers, increase deal velocity

‘With Xapien reports, our compliance team can ensure deals proceed without delays.’

Head of Compliance, leading private equity firm

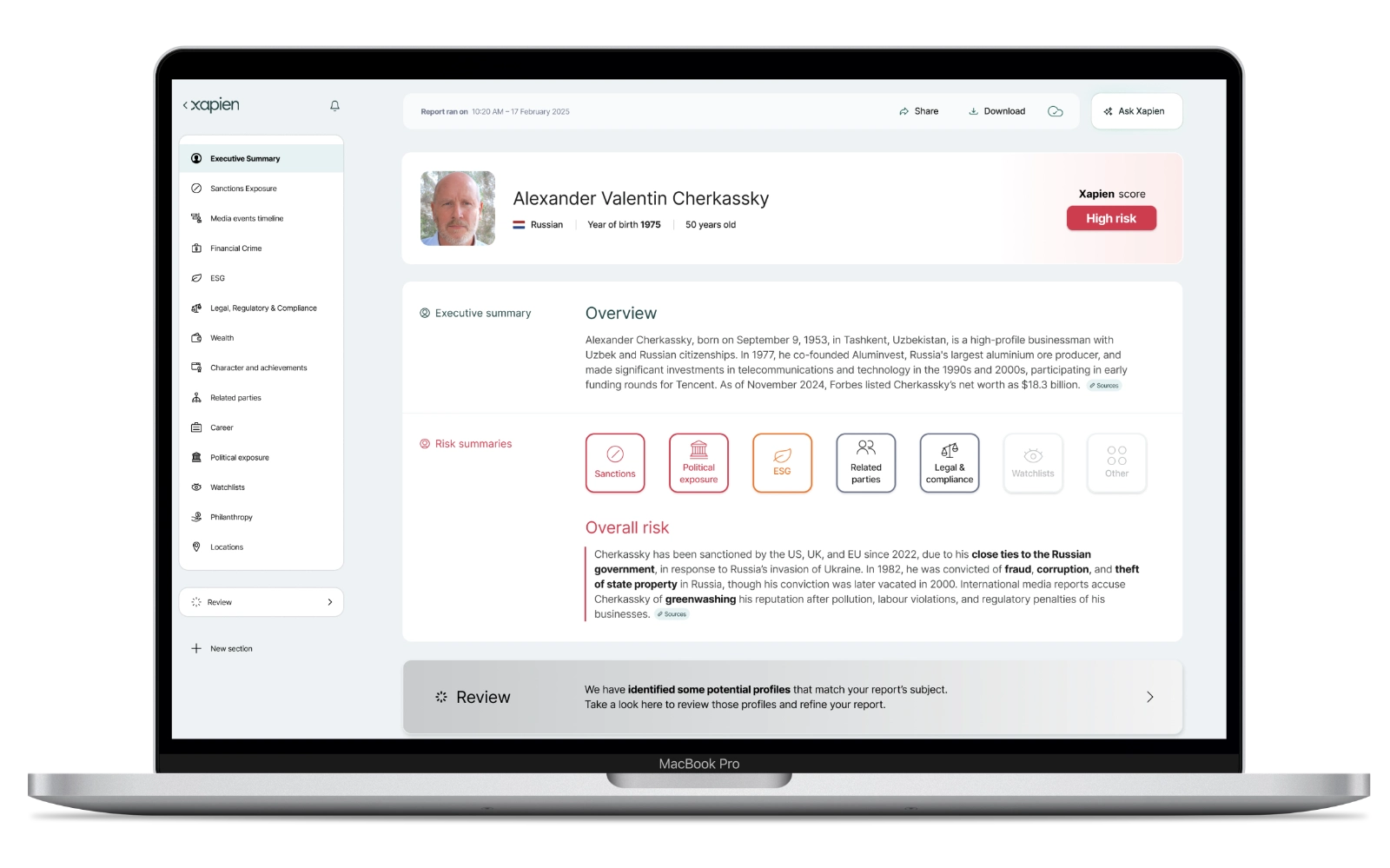

By combining half a billion corporate records with PEPs, sanctions, watchlists, and the entire indexed internet, Xapien surfaces nuance at speed. Clear, concise summaries give compliance teams the answers dealmakers need in minutes, not days.

Where trust meets efficiency

Wealth management

Protect your reputation

We know that in your field, reputation is everything. Decades of trust can be undermined by a single bad client or association. Xapien delivers deep, contextual due diligence in minutes, so you can safeguard both compliance and integrity, and protect the standing you’ve built in the market.

Don’t keep clients waiting

Your most valued clients expect service without delay. Traditional onboarding can take months, creating frustration and missed opportunities. Xapien accelerates the process, clearing low-risk clients fast while giving teams the clarity to focus on complex cases.

Spot risks, move fast

Private equity and finance

Accelerate deal flow

Due diligence on potential portfolio companies is essential but slow.

With Xapien, deal teams get a full picture on potential portfolio companies early in the process, uncovering red flags and identifying potential risks. This means no time wasted on unviable targets and a swifter, smoother start with the right opportunities.

Check investors and directors

Xapien automates investor and director checks at scale, providing clarity on 90% of low-risk cases and surfacing the real risks that need attention.

See the full picture

Insurance

Smarter underwriting

Insurers need a complete view of risk exposure before setting premiums. Xapien uncovers corporate structures, leadership backgrounds, associates, and reputational risks to help you price policies accurately.

Faster claims investigation

Xapien provides deep, contextual research on claimants in minutes, surfacing hidden risks and protecting profitability without weeks of investigation.

Actionable insights

Insights that don't just inform, they drive workflows

Discover how actionable insights become faster decisions with Xapien.

Experience Xapien for yourself

Book your personalised live demo

Jump on a 30-minute demo with one of our platform specialists, and see how Xapien goes beyond manual research and database checks to help you move faster, with confidence.