Customer success story

Portfolio companies screened in 10 minutes to improve deal velocity

“Xapien is our first line of defence, preventing last-minute surprises in the deal process."

Head of Compliance, private equity firm

Background

We work with a leading international investment firm via the head of their compliance team who is based in the UK.

The firm has three primary business lines. The most significant portion of their business is in private equity, which involves acquiring majority stakes in portfolio companies.

They identify opportunities, purchase 51 percent or more of those companies, and hold them for a period of five to seven years. On the venture capital side, they invest minority stakes in companies such as early-stage startups.

To support all these endeavours, they have several regulated businesses spread out across four different jurisdictions and regulatory regimes.

While the operations team function as the first line of defence, the compliance team is actively involved in managing a significant portion of controls traditionally associated with the first line, especially in AML (Anti-Money Laundering) and KYC (Know Your Customer) screening for portfolio companies and the firm's employees.

There are eight individuals in the firm’s compliance team the majority of whom sit in the UK with others spread out in the jurisdictions they cover due to complex local compliance regulations.

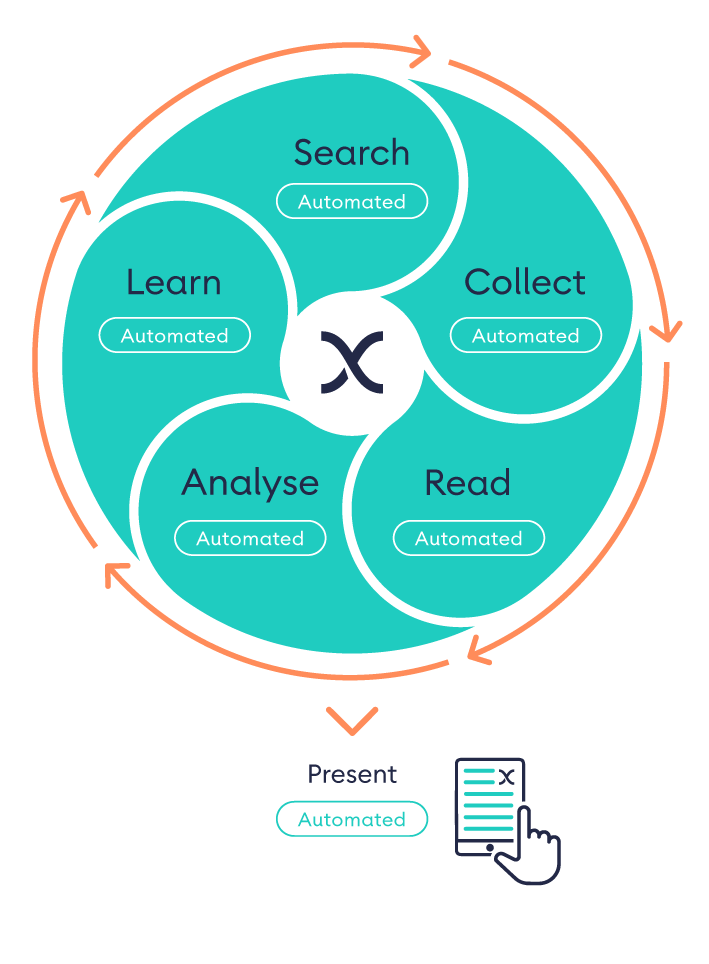

Screening process with Xapien

The compliance team have a financial crime checklist that is used throughout the screening process. It contains questions not only about documents, but whether Xapien reports have been run on all sellers, the target, and directors. This checklist ensures all necessary steps are completed before proceeding with a deal.

The process starts when the investment team approaches compliance. If the deal has come through their network, or through one of their portfolio companies, they might have information about UBOs and directors. If it's a bolt-on or add-on deal, then the investment team would typically have limited information.

In either case, the compliance team will run what they have through Xapien. This early red flag screening checks for anything that might ring alarm bells. They run Xapien reports as soon as they have the information to avoid last-minute surprises. This proactive approach allows them to catch risks early in the process and prevent both teams from investing excessive resources in a deal that might not proceed.

The compliance team then present the Xapien report to the investment team. They highlight any issues to them, especially if related to sanctions and PEP hits or matters that are controversial in the media. This is shared with the Head of Compliance, leading to discussions with the investment team on how to proceed.

Unless it involves an AML risk that prevents the deal from proceeding, the compliance team doesn't deny the deal going ahead. However, when a major red flag is identified, senior management and the lead deal team member are informed to discuss how best to navigate the deal or whether to proceed altogether.

Otherwise, the investment team continues their work with a greater understanding of their counterparty. Compliance may conduct additional Xapien reports based on new information shared with them.

“I trust Xapien to catch risks early in the process."

Head of Compliance, private equity firm

Due diligence before Xapien

Given the scale of the team’s operations they have always relied on technology to support them. Before Xapien, the firm used a different tool which would often result in more manual work than it saved. They would receive lengthy PDF reports that lacked interactivity and tended to produce false hits. The team had to sift through page after page, determining whether the information was relevant to the targeted companies and individuals. These reports typically spanned nearly 50 pages and made it challenging to discern what the direct risks were. The result was a slow process and a difficult relationship with the first line.

Due diligence after Xapien

The firm now uses Xapien to screen portfolio companies they plan to buy. The Xapien reports take 10 minutes to run and provide early insights on risks and red flags as well as highlighting complex corporate structures. This allows the compliance team to quickly confirm if a portfolio company is suitable for a deal, and get back to the first line far quicker. They are no longer responsible for holding up the deal due to extensive background research, but can provide rapid insights early on in the cycle allowing the deal team to make more efficient decisions.

Once the screening is complete, they generate reports and make assessments. Finally, it goes to a senior member of the Compliance team for approval. Xapien has significantly expedited their screening process, enabling them to focus on what truly matters.

It allows the team to quickly assess the situation and readily see where there may be criminal proceedings, ESG concerns, or signs of financial crime or sanctions violations. If there are any other flags, they can quickly click through the sourced links to learn more. Being able to easily navigate specific sections means they can filter for the information they need.

Screening employees

The firm’s HR team also use Xapien to screen employees. Since they follow the Senior Managers and Certification Regime set by the FCA, they must go through a rigorous annual assessment to ensure they remain fit and proper. Xapien plays a crucial role in this process.

The ambiguous guidance is hard to provide a “yes”/”no” answer to so the team use Xapien to complement other checks by performing comprehensive background research across publicly available information. This includes checking for any red flags related to sanctions or negative online information as well as information about an individual's broader media presence. This means they can more confidently answer the regulatory requirement of assessing an individual’s “fit and proper” status.

Screening takes five-ten minutes

Reviewing a report from their previous technology provider used to be a time-consuming process, often taking up to two hours to determine whether it was ‘clean’. With Xapien, they can often reach that level of assurance within 10 minutes.

Xapien helps streamline a process that is often inevitably disjointed. For example, they start by screening a target business and its two founders using Xapien. However, they’re told there are two more founders they didn't know about. So, they quickly screen these new founders using Xapien. Then, they find out there's another company involved, which means they need to use Xapien to check that company.

Using their previous tool, each new screening added two more hours to their workload. But with Xapien, it's just an extra 10 minutes. This means they’re not causing any delays in the deal, allowing the investment team to proceed more quickly.

Xapien searches under every rock

In one instance, the firm came across a company with a troubling background: its founders turned out to be related to an individual previously prosecuted for illicit trading to South America. This individual had faced prosecution of a disturbing crime in another country. Moreover, this company was based in a high-risk country, which added to the compliance team’s concerns.

As they delved deeper into the situation with a Xapien report, it became evident that the entire family operated together. Within ten minutes of reviewing the Xapien report, it was clear they needed to investigate further. In this case, the concern was more about reputation than compliance since the individuals had faced prosecution but weren’t found guilty, and years had already passed.

Nevertheless, there was too much suspicion for there to be no underlying problems. So, they made the decision to involve a specialist third party in that country to perform enhanced due diligence. In the end, they decided that the risk was too high and stepped away from the deal. Xapien helped them identify the risk early and make a strategic decision to avoid investing too much too early.

A firm-wide capability

Xapien has become an attractive tool for the firm’s investment professionals, as well as the HR team and compliance team. They can quickly run Xapien checks on potential targets, getting answers within 10 minutes. This quick assessment kickstarts their research process.

With the previous tool, the HR team, ESG professionals, and the compliance team lacked the ability to create, oversee, and administer groups using it. Now, they have that capability with Xapien. The Head of Compliance can effectively oversee and manage all these groups, including controlling who has access to specific functionalities. This results in a more consistent due diligence process across the firm.

Scalable with increased demand

As the firm raises more funds, it needs to deploy those funds into more investments. As a result, the deal team has grown substantially with more AML searches being run than ever. Xapien plays a vital role in enabling the compliance team to manage their workload at scale, ensuring that they can efficiently handle this growing demand.

Xapien streamlines due diligence

Xapien's AI-powered research and due diligence tool goes faster than manual research and beyond traditional database checks. Fill in the form to the right to book in a 30 minute live demonstration.