Blogs and Guides:

From static to dynamic: The future of professional due diligence

Screening tools have long been the basis of due diligence. But they only provide simple yes-or-no answers, such as hits on sanctions lists, watchlists, or politically exposed persons (PEPs). This data comes from static databases, and results only reflect the moment the search was done. That means there’s no context, no deeper understanding, and no explanation for why someone appears on a list. They also miss individuals who don’t show up as hits but still have enough public information to be considered a risk.

To fill that inevitable gap, analysts turn to search engines. But search engines weren’t built for investigative research. They deliver links, not clarity. Information is fragmented, and relevant insights are buried among countless irrelevant results. Researchers are forced to manually stitch together narratives from scattered web pages, which isn’t efficient at all.

The alternative is commissioning a due diligence report from specialist consultancies. These reports offer more depth, drawing from investigative methods and experienced analysts. But it comes at a steep price. Once delivered, they can’t be interrogated or updated. And while they may seem comprehensive, they often follow templated structures that don’t allow for the nuance or agility that’s needed to find emerging risks.

From a snapshot to real-time view

Risk profiles can change overnight. Today’s low-risk third parties could face sanctions tomorrow. A previously clean organisation could find itself exposed through changes in ownership, political shifts, or negative press. Organisations that treat due diligence as a one-time activity expose themselves to risks that reveal themselves later down the line.

As financial crimes become more sophisticated, and regulatory expectations increase, organisations are realising the importance of continuous due diligence. One of the most important shifts in recent years is the move toward dynamic due diligence, an approach that transforms professional due diligence from a snapshot to a real-time view.

Dynamic due diligence actively monitors clients, partners, and third parties throughout the lifecycle of a business relationship. It catches new red flags, whether related to money laundering, bribery, or reputational risk, as they emerge. Not months or years later.

Technology is the key enabler

Until recently, even dynamic due diligence was largely limited to the same playbook: continuous screening against AML databases and adverse media databases. But these too are static in nature, and too slow to reflect breaking developments.

The next generation of technology, namely AI, is enabling teams to go beyond screening to perform contextual due diligence. This shift reimagines Perpetual Know Your Customer (KYC) as a real-time process. Instead of relying on periodic reviews, Perpetual KYC maintains and updates a dynamic risk profile that adapts in real time.

Organisations can use AI tools to spot risks as they appear and act early. Most importantly, AI provides clear, useful reports. Not just yes/no answers or scattered data. It can analyse risks and draw connections from large amounts of unstructured data from news, blogs, court records, regulatory filings, investigative reports, and even social media.

How Xapien is breaking ground

Chartis Research identified a new but urgent need for regulated firms in its recent Financial Crime and Compliance 50 report: scalable, real-time risk assessments that meet today’s regulatory pressures and default-transparent environment.

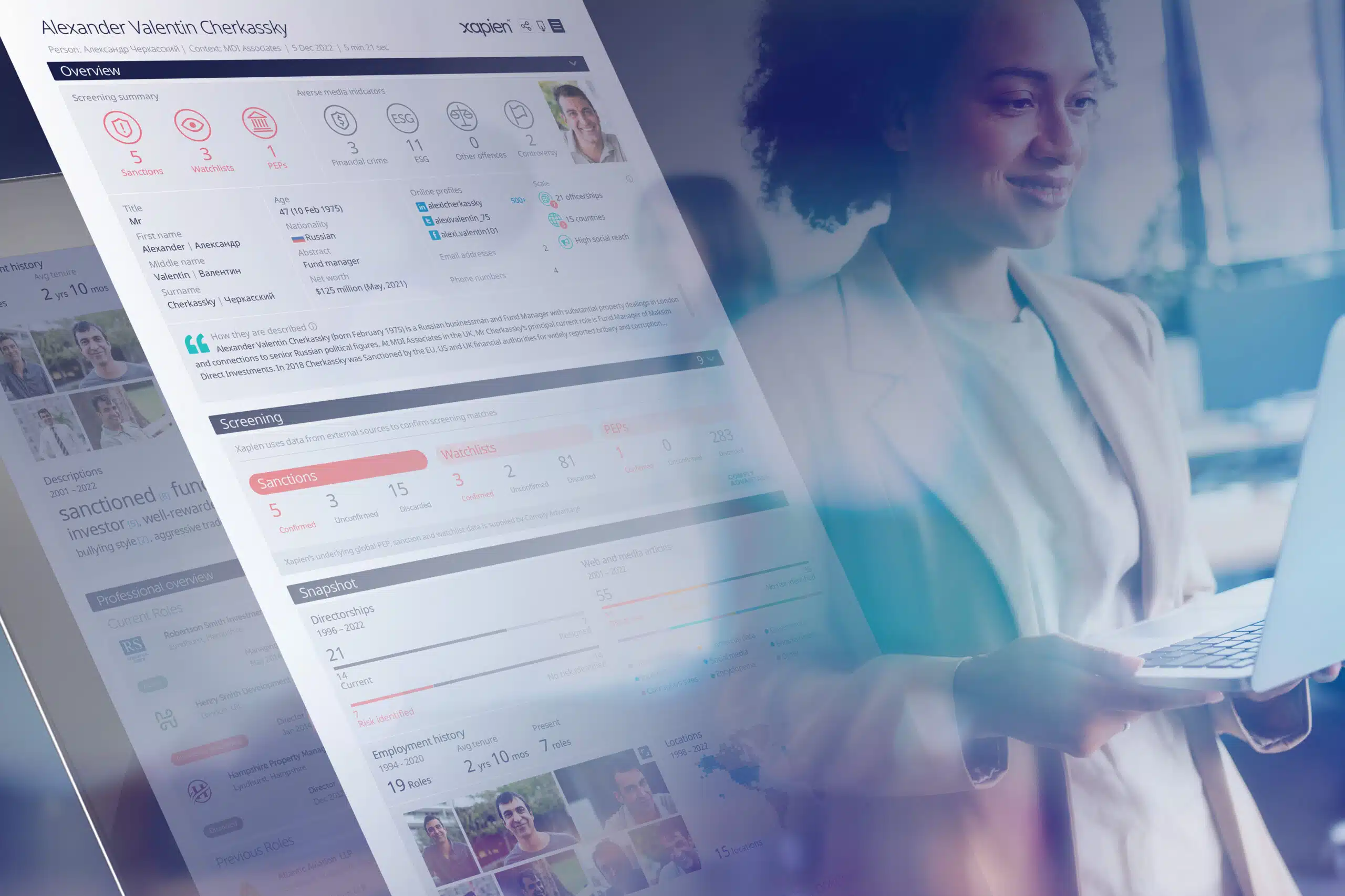

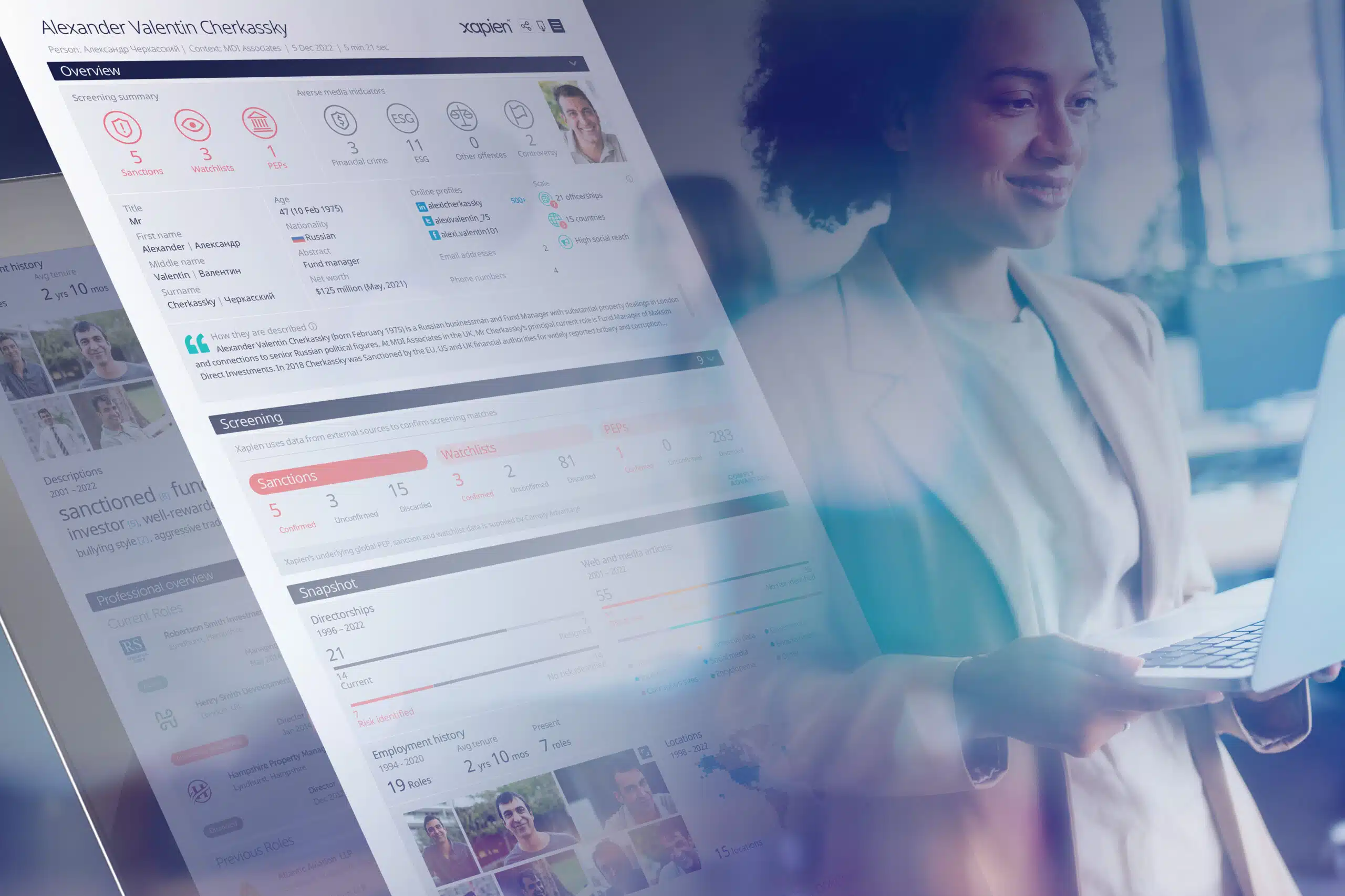

Chartis introduced a new award category in response, Dynamic Due Diligence Platforms, and recognised Xapien as its inaugural winner. Unlike legacy screening tools, Xapien enables comprehensive due diligence in minutes by combining live internet data with premium AML databases and corporate registries.

What sets Xapien apart from other due diligence tools is its ability to find risks that data providers haven’t caught yet. Whether it’s a recent allegation or a connection to high-risk jurisdiction, Xapien surfaces these new risks as soon as they enter the public domain.

The future of due diligence is real-time, proactive, and AI-powered.

As regulatory environments harden and public scrutiny increases, the organisations that succeed will be those that adapt. Not by hiring more analysts or buying subscriptions to databases, but by rethinking the structure of due diligence itself.

Monthly learnings and insights to your inbox

Xapien streamlines due diligence

Xapien's AI-powered research and due diligence tool goes faster than manual research and beyond traditional database checks. Fill in the form to the right to book in a 30 minute live demonstration.