ESG:

AI and ESG: Where’s the private market heading?

Current ESG reporting is flawed. It’s inconsistent, often unregulated, and driven by data, rather than a whole, holistic picture. And, there are no standardised guidelines or universal methods for presenting data.

Earlier this year, the leading rater of green credentials, MSCI, gave some of Wall Street’s largest banks headline rating upgrades even though they continue to lend billions of dollars to fossil fuel companies. The banks, which included Wells Fargo, Citibank, and Morgan Stanley, arranged a combined $74 billion of loans for polluting industries.

How did this happen? MSCI’s ESG ratings focus on the proportion of loans to fossil fuel companies within a bank’s lending portfolio, rather than the total sums loaned. Meanwhile, a bank that lends less but has a larger proportion of its portfolio dedicated to loans with a large carbon footprint may receive a lower rating.

This isn’t necessarily a bad approach, but it highlights just how difficult it is to accurately gauge ESG credentials. Even the leading rater of green credentials releases ratings that immediately appear flawed highlighting the difficulties of sustainable investing today.

ESG matters, but can it be trusted?

Investors know that current ESG reporting is flawed. It’s inconsistent, often unregulated, and driven by data, rather than a whole, holistic picture. There are no standardised guidelines or universally accepted methods for presenting data. As a result, businesses are left to independently determine how to aggregate and report ESG data.

Last year, ESG funds experienced net outflows for the first time, according to Refinitiv-Lipper. Oil and gas stocks surged, while technology and growth stocks – favoured by ESG investors – faced a decline. This was driven by factors such as the Russia-Ukraine war, increased inflation, rising interest rates, and investors need to preserve capital.

“There has been a lot of questioning of ESG this past year,” Marie Niemczyk, Head of ESG Client Portfolio Management at asset manager Candia, said to Reuters.

Although investor appetite for ESG credentials is not as strong as it was a year ago – in part due to investors realising that many ESG metrics are flawed – it remains an important factor.

Extreme climate events, unhappy employees and supply chain scandals can have serious effects on the bottom line.

“It is not rocket science to suggest that companies that have poor scores for E, S and G tend not to make fantastic investments over the medium to long term,” Rob Burgeman, senior investment manager at wealth manager RBC Brewin Dolphin, told the Financial Times.

Global ESG fund assets reached about $2.5 trillion at the end of 2022, up from $2.24 trillion at the end of the third quarter, according to Morningstar. Asset managers globally are expected to increase their ESG-related assets under management to $33.9tn by 2026, according to EY. That’s 21.5% of total global assets.

Investors still want to invest sustainably. The energy crisis has underlined the importance of moving away from fossil fuels. The US Inflation Reduction Act and the European Green Deal have provided massive tax breaks and volumes of capital to companies that facilitate this.

Enhanced regulations

Regulators in the US have imposed fines for greenwashing. Additionally, governments on both sides of the Atlantic are introducing a new definition for sustainable funds, resulting in a notable decrease in the number of ESG-compatible funds.

For instance, the UK’s Financial Conduct Authority intends to differentiate between funds that solely exclude specific sectors or stocks and those that invest in actively sustainable companies.

ESG regulatory and disclosure requirements are experiencing global expansion, with a particular focus on Europe. This expansion involves key players such as…

Global

Basel Committee on Banking Supervision (BCBS): Sets framework for managing climate-related financial risks. Aims to improve banks’ risk management and supervisors’ practices.

International Sustainability Standards Board (ISSB): Develops and approves global IFRS Sustainability Disclosure Standards.

Task Force on Climate-/Nature-related Financial Disclosures (TCFD/TNFD): Establishes risk management and disclosure frameworks for climate and nature-related risks.

European

European Central Bank (ECB) guide on climate-related and environmental risk: Outlines supervisory expectations for banks’ approach to ESG risks, including disclosure requirements.

European Banking Authority (EBA) guidelines for loan origination and monitoring: Covers ESG risk considerations throughout the loan life cycle.

EBA guidelines on internal governance (second revision): Requires consideration of ESG risks within the risk management framework and business model.

ECB Climate Risk Stress Test: Assesses banks’ capabilities in assessing climate risks.

EBA implementing technical standards (ITS) on Pillar 3 disclosures on ESG risks: Sets disclosure standards for large institutions on ESG risk management.

EU Non-Financial Reporting Directive (NFRD): Requires large public-interest entities to publish non-financial statements, including climate-related information.

EU Sustainable Finance Disclosure Regulation (SFDR): Mandates ESG-related information disclosure for investors.

Future regulatory developments include the SEC climate-related disclosure rules, UK green taxonomy, and EBA guidelines on ESG risk management.

AI and ESG

As regulators and investors demand more transparency, AI is helping the assessment process. If it’s applied in the right way, it can help rebuild trust in sustainable investing.

AI-driven ESG ranking and reporting systems have become widespread over the past few years. However, these ranking systems cannot accurately capture or weight a company’s ESG policies or regulations, nor offer a holistic picture of the company.

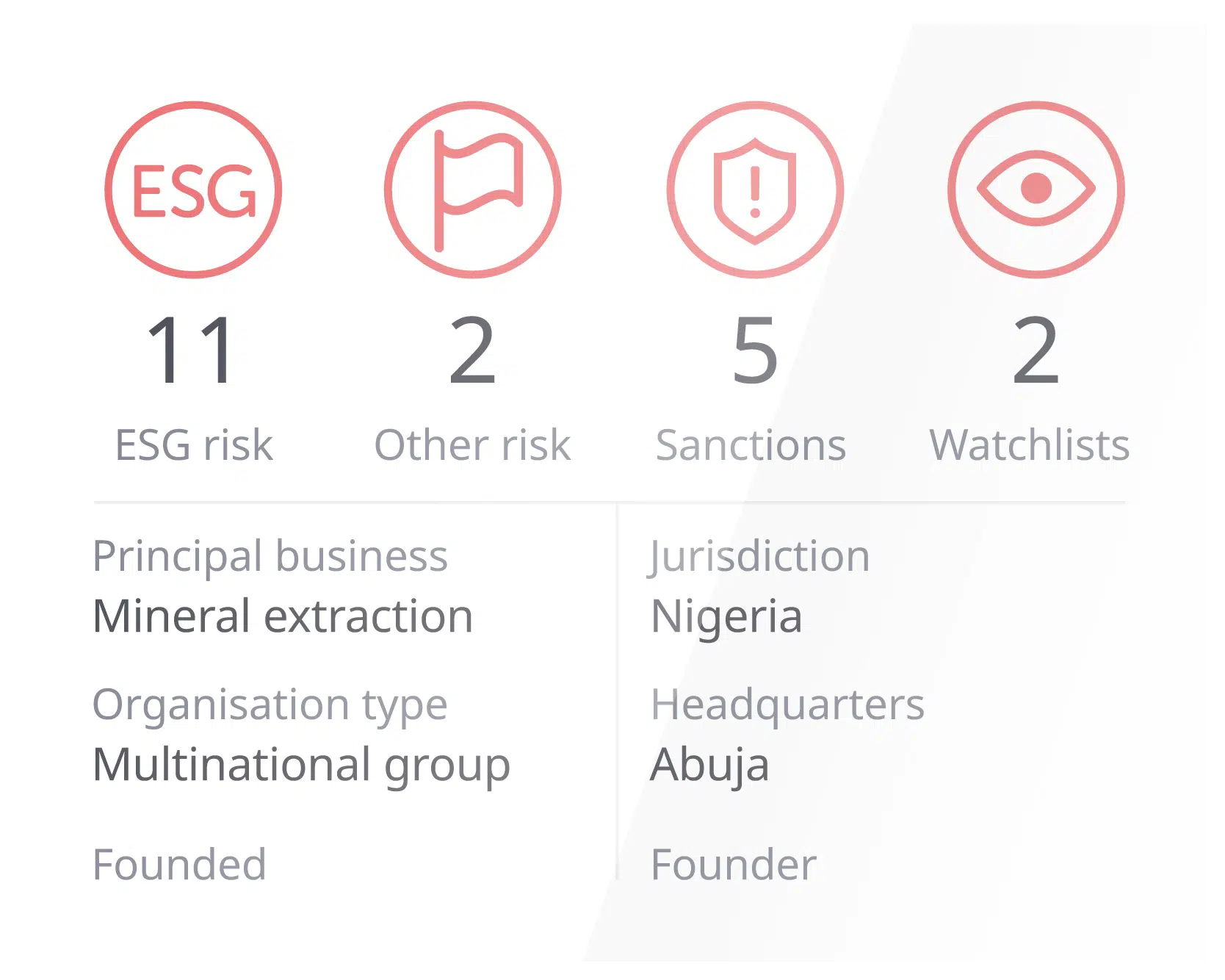

Xapien is different. Its next-generation AI harnesses carefully trained AI models and Natural Language Processing to search the entire indexed internet in five to 10 minutes. That includes all online corporate records, shareholder data, media and news articles, and more.

It recognises, understands and categorises patterns and connections which reveal ESG risks. And in minutes, it can uncover information that might take analysts days to find. This helps balance the need to move quickly to complete deals with the need to carry out careful, focused ESG due diligence.

Data quantity

“ESG investment comes in 50 shades of green and the issues it seeks to address are far broader than simply climate change, and range from social inequality to empowerment of women to food production to water scarcity, all the way to the more traditional drive to carbon neutrality. It has been and is likely to remain one of the driving factors for investment for the foreseeable future,” Rob Burgeman added.

New ESG risks are emerging all the time. Greenwashing – when public statements on emissions reduction fail to match the company’s actual performance – is now heavily condemned. The entire supply chain now matters. Companies are criticised when their suppliers’ labour practices breach ethical standards.

Knowing what to look for is hard enough when there is an almost infinite amount of information available online. With ESG risks varied and nuanced, not knowing what might be relevant makes the job impossible using traditional techniques.

How AI helps

AI algorithms can process and analyse large volumes of data, identifying relevant patterns, and uncovering insights that may not be easily found using traditional methods. By leveraging AI, investors and companies can gain a deeper understanding of ESG risks and performance, enabling more informed decision-making and effective risk management.

Xapien reports only contain information that’s relevant to your search. It won’t mix your subject up with someone else with the same name. It goes beyond records and watchlist checks to read all publicly available online content on your subject so that you can really understand the ESG risk they pose.

Research is an iterative process. It joins the dots that researchers can miss by reading and ‘learning’ with each search. For example, if a news article identifies a problematic supplier, Xapien will make the link to corporate data which gives the CEO’s date of birth.

Data quality

ESG risks cannot be measured in the same way as risks like fraud or criminal activity. Environmental risk, labour abuses, and a lack of diversity are nuanced, thematic and poorly defined, making them challenging to identify. Even worse, they often rely on a company’s self-declared ratings, which can be biased and subjective. This reliance on self-reported numbers poses challenges in accurately measuring and evaluating these risks.

This is a challenge in the private equity sector, where there is often even less ESG data. When ESG metrics are disclosed, the information is rarely transparent or standardised. This makes it difficult to determine whether these funds genuinely align with ESG goals.

How AI helps

Xapien gives a thematic and holistic picture of your subject, allowing you to judge results set in context. It doesn’t use inputs from the company or look at how the company reports its own ESG compliance. Instead, it looks from the outside in.

By searching real-time internet data, it reveals how the external world sees the entity in question, and can expose issues that database searches wouldn’t even find.

For example, a company might report a male to female staff ratio of 55:45. Pretty good, you might think. However, a Xapien report would find that a junior, female, staff member had left the company and posted online that the company was failing to promote women. This wouldn’t necessarily be an ESG risk in itself, but could indicate a problem that you are now able to investigate further.

Time and resources

Last year, 95% of law departments – who play a leading role in ESG management – said balancing financial and sustainability goals was a challenge. Almost all of them (99%) expected their workloads to increase over the next three years because of ESG.

Managing ESG is a balancing act. As we’ve covered above, there are an almost infinite number of potential risks that firms need to uncover with finite resources.

How AI helps

AI helps you find relevant information quickly, so you can focus on decision-making.

In minutes, Xapien can uncover risks that it would take a team of researchers days to discover. Its neural risk classifier can understand the meaning of words, allowing it to distinguish between genuine risks and non-risks and reduce the margin of error (irrelevant information) significantly. Previously, this had to be done manually, with researchers carefully reading through every piece of information to determine relevance.

“I cannot overstate how much easier due diligence is with Xapien. Enhanced due diligence on a prospect used to take the better part of a day. You can sometimes go down a rabbit hole of searches and reviewing news stories to try to determine whether they are proven, hearsay or media speculation. Xapien enables us to get all of that data in 12 minutes or less. Now, I can leave Xapien running in the background while attending to other compliance needs.”

Alex Nash, Money Laundering Reporting Officer, Griffin

The importance of Explainability

The lack of transparency around ESG reporting has damaged its appeal to investors. AI can solve this, but it could also make the issue worse if it’s not clear where the results come from. To make an informed decision, humans must be able to understand where information has been sourced from and why.

Xapien’s algorithms are explainable, meaning anyone can understand how our technology works.

We don’t use inputs from the company or look at how the company reports its own ESG compliance – it looks from the outside in. Every risk it uncovers is clearly summarised and sourced, enabling you to make fully informed decisions.

Conclusion

ESG remains an important factor for investors, who want to invest sustainably and understand that extreme climate events, supply chain scandals, and other ESG-related issues can have a significant impact on a company’s bottom line. As ESG regulations and disclosure requirements expand globally, the integration of explainable AI in the assessment process can help rebuild trust in ESG investing, empower investors with deeper insights, and promote more informed decision-making.

Monthly learnings and insights to your inbox

Xapien streamlines due diligence

Xapien's AI-powered research and due diligence tool goes faster than manual research and beyond traditional database checks. Fill in the form to the right to book in a 30 minute live demonstration.