What tools are best for client onboarding due diligence?

The most effective tools for client onboarding due diligence leverage automation and advanced data analysis to provide fast and accurate insights. These tools enable organizations to efficiently assess potential risks, uncover critical details like business associations, political affiliations, and compliance issues, and ensure alignment with AML and KYC regulations.

The best tools for client onboarding due diligence, automate the analysis of critical data. Allowing organizations to make quick, informed decisions.

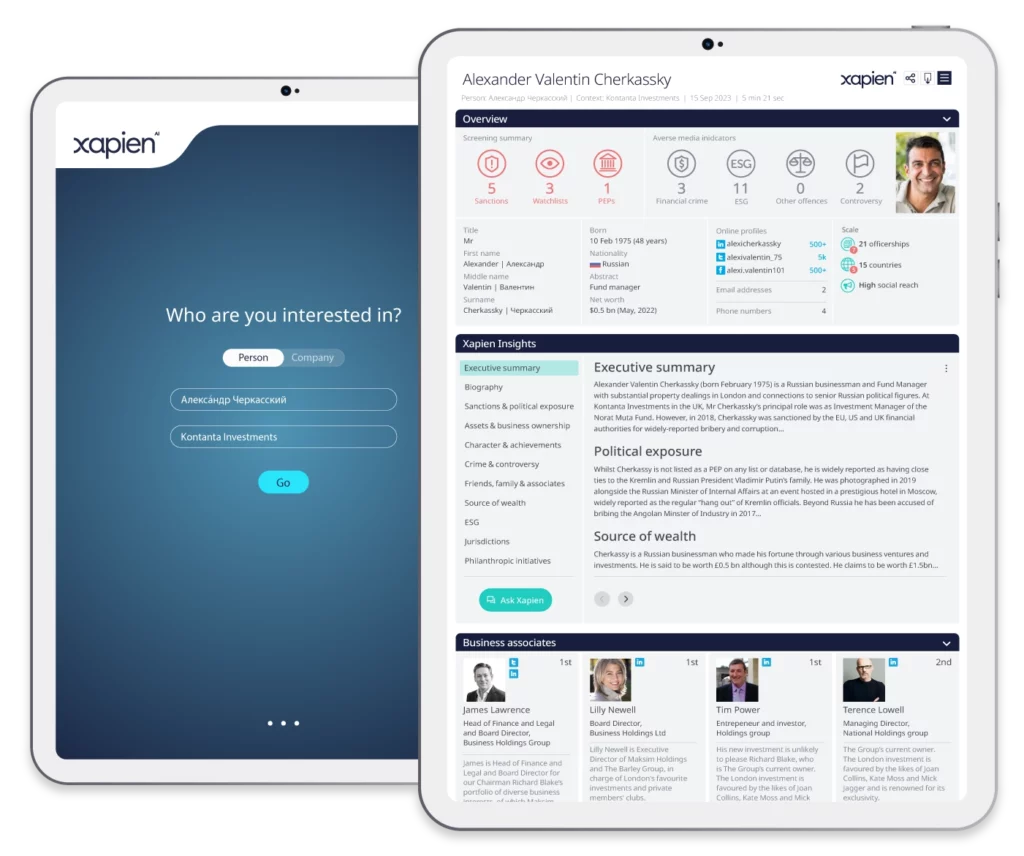

Xapien, an AI-driven due diligence tool, provides a comprehensive platform that taps into vast datasets, including 0.5 billion corporate records, 1,500 watchlists, and 35 trillion web pages. This extensive data helps uncover key insights, ensuring compliance with AML and KYC regulations by analyzing political affiliations and exposure to sanctions.

Due diligence in minutes, not days.

Trusted by

KPMG

Mintz

Pinsent Masons

Dow Jones

Dartmouth

Griffin

University of Liverpool

Zurich

Provenir

YFM Equity Partners

University of Manchester

Hopehead

University of Alberta

Sightsavers

Museum of London

Anglia Ruskin University

Cytora

Why use Xapien?

Xapien goes beyond traditional due diligence by exploring open-source data, such as media coverage, to identify potential risks and connections that may not be immediately visible. By automating the research process, Xapien enables organizations to scale their due diligence efforts, reduce human errors, and make confident decisions with up-to-date, actionable insights.

By eliminating user bias and automating the entire process, Xapien ensures consistency and depth in every due diligence report. This makes it an invaluable tool for compliance teams, allowing them to scale their efforts, reduce manual work, and make well-informed decisions without the need for additional resources. Moreover, Xapien offers:

Rapid turnaround: Traditional due diligence can take days, delaying operations and billing. Xapien delivers comprehensive reports in minutes, accelerating your processes and keeping your business moving forward.

KYC redefined: Too often KYC is a tick box exercise. Xapien provides the full story. Make complex, nuanced decisions about whether you should work with an entity or individual (a nuanced ethical question), and not just whether you can (a binary regulatory question).

Regulatory compliance: Stay ahead of regulatory requirements and mitigate potential fines and brand damage with thorough, automated due diligence that leaves no stone unturned.

Smarter due diligence: Use Xapien to conduct early due diligence, saving time and confidently assessing new prospects before committing to new relationships.

Join the ranks of esteemed institutions like Dow Jones, Zurich, Pinsent Masons, Dartmouth College, and KPMG,

who trust Xapien for their due diligence needs. Find out more about Xapien here

What a Xapien report shows

Searching, verifying, and matching records is slow and tedious.

Xapien makes thousands of decisions, so you only have to make one.

At a glance

Xapien combs through the records to flag insolvencies and other corporate risk indicators, giving you a high level view of your subject's portfolio.

Industry breakdown

You can see at a glance the industries in which your subject operates, be that healthcare, pharmaceuticals or minerals and mining.

All the detail

View the key corporate activity in a glance from name changes to locations and trading status.

Risk

Xapien highlights regulatory, reputational and values-led risks. This includes corporate insolvency risk, jurisdictional risk, and early signposting of ESG risks.

Locations in context

Every address is shown on a map, alongside streetview images giving you a textured view of where your subject operates from.

Connections and associates

Xapien will surface all close associates. Corporate records as well as open-source data are analysed to extract family members, business partners and overlapping directors. Map out networks at a glance.

How Xapien supports your

due diligence

Xapien covers

0.5bn corporate records, 1500 watchlists, 140 jurisdictions and 35tn web pages.

Xapien extracts

- Business associations

- Professional history

- Directorships (including UBO and PSC, PEP, Sanctions and watchlists exposure)

- Political affiliations

- Adverse (and positive) media coverage

- Media events timeline

- Family members and close associates

- Charitable activities and donations

- Property, assets and source of wealth

- Locations

Ask Xapien

Ask any question about your subject and receive fully-sourced replies.

New to Xapien?

Discover our resource hub for the latest news, insightful ebooks, and engaging webinars designed to empower your due diligence strategy and keep you ahead in today’s fast-paced world.

Frequently asked questions

Have questions about Xapien? Visit our FAQs to learn more about our services and how we can assist you.

Get started. Book a demo.

Accreditations and recognition