As proud gold sponsors, our team attended the Law Society’s Risk & Compliance Conference 2024. Here, we’ve summarised the key themes that stood out the most.

Fining powers of the SRA under scrutiny

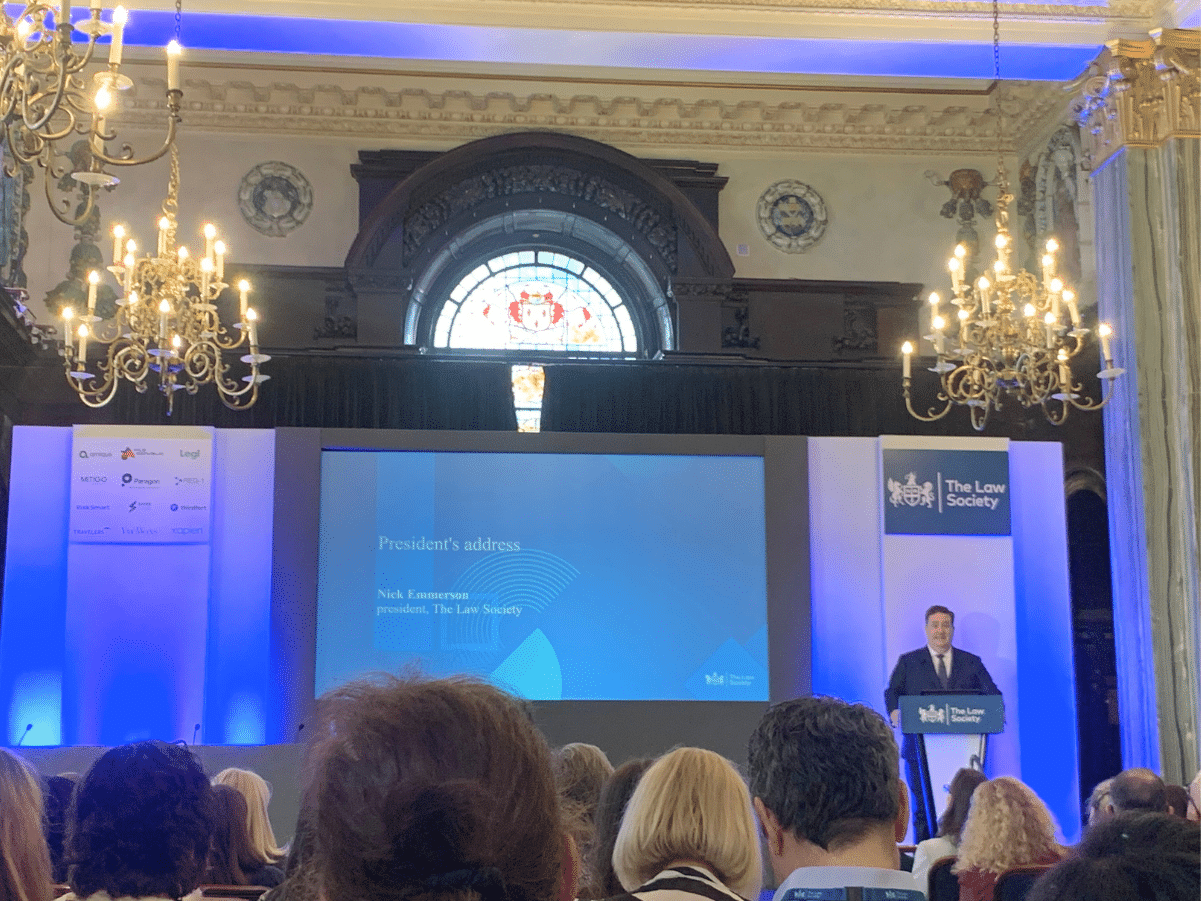

The conference started on a strong note with the Law Society’s President, Nick Emmerson, delivering his opening address on a topic that remained in the spotlight throughout the event: the expanding fining powers of the SRA, which the Law Society strongly opposes.

To summarise briefly: firms involved in economic crime now face unlimited fines from the SRA, while fines for other offences have increased from £2,000 to £25,000 in recent years.

The Law Society is urging the government to limit these fines, concerned that it’ll undermine the Solicitors Disciplinary Tribunal (SDT). While the SRA aims to extend this to all offences, the Law Society doubts this is credible.

Emmerson’s message was clear. As the SRA’s authority grows, he said, “The regulatory landscape is changing, and we must be prepared for such changes.”

The changing face of risk & compliance

This sentiment was echoed by Iain Miller, partner at Kingsley Napley LLP, who emphasised that not only will the SRA soon have unlimited fining powers for financial crime, and possibly even broader offences, but it’s not afraid to use them and publish its decisions.

This has increased the challenges faced by Risk and Compliance professionals, transforming their role significantly as risks have become more complex to manage.

For instance, when onboarding a client, firms must now weigh not only AML and regulatory risks but also reputational risks. They face complex decisions, understanding that accepting one client and potentially alienating future clients is a risk alone.

Moreover, the stakes related to matter risks have heightened – reputation management and litigation now fall under regulatory scrutiny, whereas they didn’t just a few years ago. And issues that were previously considered HR matters now involve the regulator.

He acknowledged that spotting future risks to ensure that Risk and Compliance professionals are effectively doing their jobs is the most complicated thing to do. While predicting future risks is impossible, they will undoubtedly differ from today’s risks, just as today’s risks differ from those of yesterday.

We’ve already witnessed the shift from tick-box compliance processes, where risk and compliance teams once relied on static databases and curated lists to identify AML risks. However, these static sources are not adaptable enough for today’s dynamic business environment, let alone for what the future may bring.

Key takeaway: what law firms are currently doing may not be acceptable in the future.

Finding the right balance in legal ethics

There are additional skills that will help to deal with this complexity: culture and legal ethics. The SRA is particularly paying closer attention to culture and wellbeing. When a law firm has a good culture, it means less mistakes made and better outcomes for clients.

Legal ethics is about upholding the rule of law in society, which is important. But that in itself is nuanced and complex. Iain emphasised the need to distinguish between a firm’s decision not to engage with certain clients, perhaps due to reputation concerns or regulatory decisions.

Yet, it appears that the SRA is starting to blur these lines.

Another challenge is the tension between a lawyer’s duty to act in a client’s best interests and maintaining the justice system’s integrity. While the SRA often mentions ‘upholding the rule of law and serving the public interest,’ it questions whether this truly exists.

Public interest varies significantly for lawyers compared to professions like healthcare workers. Iain warned against the SRA overstepping its bounds and inhibiting lawyers’ ability to advocate for their clients effectively. Achieving the right balance here is important, he concluded.

Aligning regulatory priorities

Richard Farquhar, Financial Crime and Risk Manager at Ashurst, also moderated a panel on how law firms can manage their compliance in the current regulatory environment.

A key talking point was templates and how a ‘cut and paste’ approach may restrict firms from complying with AML regulations. While the panel acknowledged the quality of the templates provided by regulators, they emphasised the importance of flexibility.

The consensus was to treat the templates as guidance and customise them according to each firm’s needs.