In the lead sponsor session of the WSJ Risk & Compliance virtual forum 2022, Deloitte & Touche LLP put forward the business case for climate action. It was a worrying picture.

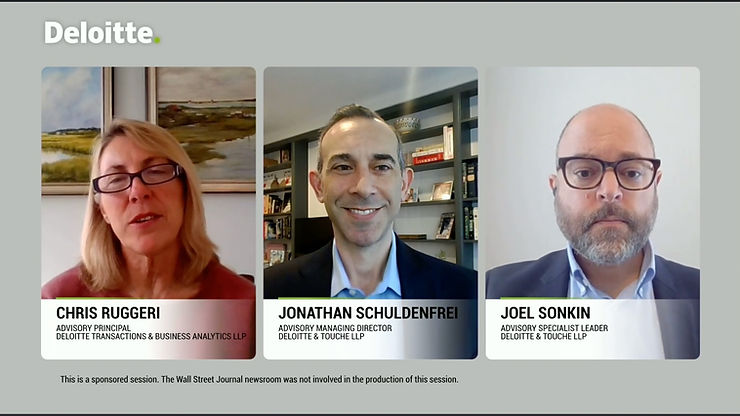

The speakers:

Jonathan Schuldenfrei | Advisory Managing Director, Deloitte & Touche LLP

Joel Sonkin | Advisory Specialist Leader, Deloitte & Touche LLP and

Chris Ruggeri | Advisory Principal, Deloitte Transactions and Business Analytics LLP

explained the two key climate-related risks that businesses will face in the coming years:

- Transition risk – not keeping up with the pace of change as the world adapts to new climate realities and imposes new standards and regulations. Examples of this would be jurisdictions applying regulations, the rise in the price of Carbon, or simply evolving consumer demands that mean that you need to find alternative suppliers or rethink your business model entirely.

- Physical risk – damage to a business/ its operations/supply chain due to environmental hazards that result for climate change such as tornados and wildfires. This can also be chronic risks that evolve over time, such as prolonged droughts or intense heatwaves which affect labour availability, agricultural production levels etc.

So what can be done about this?

The first step, as with all kinds of risk, is to understand your risk exposure so that you can understand the risks and opportunities that are specific to your business. The way we see it at Xapien, due diligence on your entire supply chain is fundamental to this. You need to have a clear picture of your partners, suppliers, and associated organisations in order to fully understand your risk exposure.

But how?

The world is awash with flawed, inconsistent climate-related risk reporting and metrics. Really understanding your supply chains requires more nuance than current, unstandardised metrics offer. But doing this kind of research on every individual or entity in your supply chain would take weeks, months, years and come at a hefty price for most organisations. So companies face a choice:

Option 1: Apply the “risk-based approach”, decide they simply can’t afford to do this level or due diligence, and become comfortable with being risk exposed.

Option 2: Outlay large sums of time and money to agencies and consultancies to do this work for them.

At Xapien we want to bridge this gap. Xapien provides fully automated in-depth background research reports or any individual or company anywhere in the world. Our reports take 10 minutes to run and provide rapid early insights on a plethora of climate and other ESG risks in one go.

Our clients use Xapien early on in the decision making progress, which enables them to avoid getting bogged down in varied, messy and inaccurate data. They can then be selective about where they need to dedicate significant more resources to any deep climate risk investigation, and where the coast is clear to proceed and make rapid business decisions.

Get in touch with us now if you want to understand your full risk exposure across your supply chain, and their supply chain, so ultimate you can:

- Take back control of your climate risk exposure.

- Keep ahead of the rapid pace of regulatory change and changing market demands

- Secure the sustainability of your supply chains.

- Turn your ESG risk management into a competitive advantage, given the pace of change of climate and ESG issues more broadly.

Speak to one of our team today to find out more about our ESG risk reporting software.