Pricing and packages

Single-team

You're a small organisation struggling to keep up with research volumes. How can you scale your research capabilities to meet growing demands without compromising on quality?

Multi-team

You're an established business with a combination of tools and manual processes. You know you could be more efficient, so what could fully automated research unlock for you?

Enterprise

You're a large enterprise with growing regulatory compliance and reputational risks. You need an enterprise solution that can keep up.

I'm a single user — can you help?

YFM Equity Partners

University of Manchester

Hopehead

University of Alberta

Sightsavers

Museum of London

Anglia Ruskin University

Cytora

KPMG

Mintz

Pinsent Masons

Trust Alliance

Dow Jones

Dartmouth

Cordaid

Griffin

University of Liverpool

Zurich

Provenir

YFM Equity Partners

University of Manchester

Hopehead

University of Alberta

Sightsavers

Museum of London

Anglia Ruskin University

Cytora

KPMG

Mintz

Pinsent Masons

Trust Alliance

Dow Jones

Dartmouth

Cordaid

Griffin

What's included?

Shareable

Shareable

Easy to share with colleagues using Xapien and external parties without an account.

Fair usage

Fair usage

Running more reports than estimated? We won't charge overages without your consent.

Customer support

Customer support

There to guide you through your usage, ensuring you get the best out of the tool.

Security

Security

UK GDPR compliant. All data is encrypted in transit and at rest. Aggregation ensures searchers are unattributable. ISO 27001: 2022 certified.

Quick setup

Quick setup

Zero implementation costs. Log in from your browser and start running a report in minutes.

For everyone

For everyone

Training and onboarding is included for all new users, anytime.

Customer stories

Griffin is creating the bank you can build on with an API-first, full-stack Banking as a Service platform. Compliance is a key offering so it’s vital that Griffin upholds industry best practices in its own third party risk management. It used to take at least a day to perform due diligence on every prospect, or supplier. This held back business growth.

Thanks to Xapien, enhanced due diligence on the directors of prospect companies and suppliers have gone from a resource-intensive one-day process to detailed evidence-based reports in under 12 minutes. The insights provided by the compliance team are shared with sales teams within hours, not days, so Griffin can get on with building a rapidly scaling business.

Customer Stories

Griffin

The University would conduct extensive prospect research and cultivate the relationship until a certain point where they would ask for a gift. At that stage, if something adverse came up in due diligence it could create a complicated situation for the fundraisers to unwind. Moreover, they’d already invested a large amount of time and effort into a gift they’d then have to turn down.

Xapien optimised the operations team's process by building due diligence into prospect research from the start. Instead of spending hours on manual research, Xapien surfaces all relevant information about a prospect in minutes. This means due diligence can be done upfront without holding up the prospect research process. By combining the two processes early on, it helps the fundraising team focus their efforts on which prospects to approach for donations.

Customer stories

University of Liverpool

The development team’s due diligence process involved a template with specific information requirements. Each team member would manually search for this information online, which meant carefully researching and reviewing news articles, Wikipedia, and company websites one by one, before analysing and summarising the findings.

This was time-consuming, taking half or day—or sometimes an entire day—to compile a report to the expected standard. There was also the risk of human error. Individuals might overlook critical details, leading to variations in quality depending on who was doing the research. This lack of uniformity made sharing the information with senior leadership a challenging task.

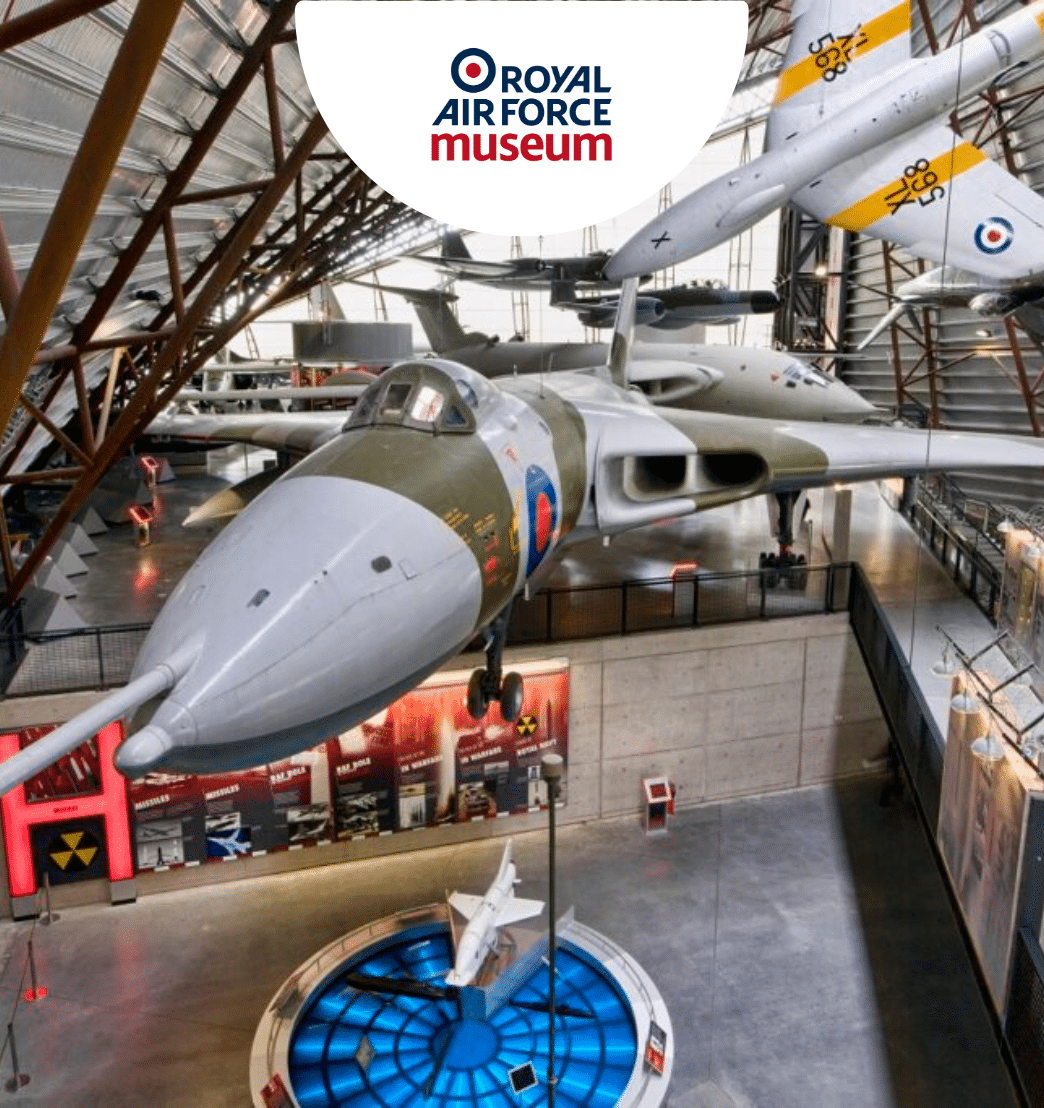

Customer stories

Royal Air Force Museum

The Operations team had one Research Assistant carrying out the entirety of their prospect research, which carried a lot of unnecessary risk. While great at finding information, the researcher didn’t have enough experience to interpret and assess various risks and there was a risk they might something. The research process was also entirely manual, which was time-consuming and, in some cases, patchy. The researcher would end up spending most of the time looking up information on databases and search engines, and then writing up the results, leaving little time for analysis and interpretation.

Xapien alleviated all these risks by automating the fact finding. Now, Paula and her team spend more time interpreting the risks that Xapien surfaces and categorises rather than collating the findings. They’ve gone from 4 to 5 hours of reading hundreds of articles online to running a comprehensive report in 15 minutes. Paula’s team can deliver value to the rest of the organisation by adding strategic advice on top of their insights. They stopped wasting time on less problematic cases at the outset and instead prioritised risky subjects and developed strategies for how the University could deal with them.

Customer stories

Newcastle University

The Prospect Research Manager, being the sole researcher at Sightsavers, is responsible for all research and due diligence checks. This research, whether it’s a quick review or in-depth investigation, would often take a couple of hours to an entire day or even longer. In turn this this would cause delays to fundraisers being able to commence stewardship and delays in the delivery of bespoke research projects.

Integrating Xapien into the workflow has proven to be a game changer for the Prospect Research Manager, enabling them to handle multiple research and due diligence requests with remarkable efficiency and speed.

Xapien has become an indispensable research tool eliminating the need to dedicate entire days to due diligence research. This has resulted in quicker approval and grant processes and fostered better relationships with potential donors.

Customer stories

Sightsavers

The Museum of London has a small team of three who manage the entire advancement practice and only one person who is responsible for their entire research function. The Museum does not have a large existing pool of donors that they can leverage. They needed to scale the fundraising efforts rapidly, with limited resources.

Ciara FitzGerald-Graham, the Museum's Fundraising Intelligence Manager, adopted Xapien for her research and due diligence. With Xapien's AI-generated reports, she gets comprehensive due diligence results in minutes, not days. This saves her time and lets her focus on prospecting and scaling their fundraising efforts.

Bonus: Running a Xapien report provides the team with an extra layer of security that all risks have been checked, protecting the organisation from reputational risk.

Customer stories

Museum of London

Hopehead were using a variety of databases and tools for their due diligence process, but their team had to manually search the open web to piece together a picture of an individual or organisation. It was a time-consuming and challenging process, and there was always the risk they might miss something.

With Xapien's on-demand research tool, Hopehead are confident they've thoroughly searched through every relevant piece of information on the open web. What used to take up to 4 hours now takes around 30 minutes, with an additional 10 minutes to review and extract relevant information for the final report.

Bonus: Xapien adds an extra level of assurance to Hopehead’s scoping process, enabling them to send out client proposals quickly and efficiently.

Customer stories

Hopehead

The research team endeavours to dedicate as much time to proactive research—finding new prospects and exploring emerging leads—as they do to reactive research, which involves investigating existing individuals in the pipeline. However, with over 20 fundraisers to support, achieving this balance is a challenge – more time is spent responding to reactive fundraiser requests than carrying out new-name identification, which limits the organisation’s ability to expand into new areas.

With Xapien, the information that would sometimes take the research team up to half a day to uncover through desk research can now be found in just 10 minutes. This timesaving enables research profiles to be written and delivered in half the time, freeing up researchers to engage in proactive research.

Customer stories

The University of Manchester

Given the scale of the team’s operations, they have always relied on technology to support them. Before Xapien, the firm used a different tool which would often result in more manual work than it saved. They would receive lengthy PDF reports that lacked interactivity and tended to produce false hits. The team had to sift through page after page, determining whether the information was relevant to the targeted companies and individuals. These reports typically spanned nearly 50 pages and made it challenging to discern what the direct risks were. The result was a slow process and a difficult relationship with the first line.

The firm now uses Xapien to screen portfolio companies they plan to buy. The Xapien reports take 10 minutes to run and provide early insights on risks and red flags as well as highlighting complex corporate structures. This allows the compliance team to quickly confirm if a portfolio company is suitable for a deal, and get back to the first line far quicker. They are no longer responsible for holding up the deal due to extensive background research, but can provide rapid insights early on in the cycle allowing the deal team to make more efficient decisions.

Customer stories

Leading private equity firm

The General Counsel at Pinsent Masons recognised that digitisation was essential for the compliance team to conduct due diligence earlier in the onboarding phase in a way that better balances resources. However, the firm faced challenges in finding a tool that was both reliable and trustworthy. This led them to partner with us to co-develop the legal market’s first AML due diligence tool powered by a Large Language Model (LLM).

When integrated into the process, the firm expects low-risk clients to be cleared in hours as opposed to days. Rather than spreading their focus equally across all clients, Xapien will enable its analysts to allocate resources more effectively to higher-risk cases, applying the appropriate level of AML controls to each client and focused ongoing monitoring.

Customer stories

Pinsent Masons

Zurich conducts thorough investigations on Commercial Companies as part of their operations. The process involves collecting data from multiple records to validate policy responses and ensure accurate risk assessments. This used to be a time-consuming, labour-intensive process.

With Xapien’s AI-powered technology, Zurich’s claims investigations team gather comprehensive corporate information about individuals in 10 minutes. Zurich uses these reports to make quick, confident decisions about all investigation subjects, protecting the institution from risk.

Customer Stories

Zurich Insurance

Dartmouth initially adopted Xapien to support its existing reputational risk research methods. However, Xapien quickly replaced many traditional tools and methodologies. Xapien not only formed part of a robust reputational risk process but also centralised the function across the university.

The ability to perform due diligence and produce comprehensive reports at scale has allowed the team to clear a backlog of donors awaiting checks before this process was fully implemented. In addition to this, Xapien enables due diligence to be done at an earlier stage on prospects.

Customer Stories

Dartmouth College

Dow Jones’s Risk & Compliance team recognised a growing need for deep and broad due diligence on an increasing number of counterparties. But clients also needed their programs to be cost-effective while delivering results fast. Dow Jones wanted to transform the due diligence process for its clients.

By partnering with Xapien, they reduced the time needed to run a background check from days to minutes. The combination of Xapien’s groundbreaking AI and Dow Jones’s world-leading data set is reshaping risk management workflows, creating an additional layer of investigation that can be deployed at scale.

Customer stories

Dow Jones Risk & Compliance

The donor due diligence process involves different teams collaborating. First, the prospect research team delves into a prospect's background, while the fundraising team examines and sends requests for additional investigation. Afterwards, the due diligence team carries out a personalised background check and risk assessment, which can take up to two days. But the real challenge starts when concerns arise after a relationship has been established. At that point, a significant amount of resources has already been invested in the process.

Xapien's automated background reports provide a full picture of any person or organisation, anywhere in the world, in 5 to 10 minutes. The platform reads and analyses data from across the internet to deliver consolidated, insightful reports including flagged risks, wealth estimates, assets, and associates. By integrating due diligence with prospect research, the two processes work hand in hand instead of holding each other back. Armed with this knowledge, Cambridge University can confidently move forward with fundraising, knowing they have a solid understanding of their prospects.

Customer stories

University of Cambridge

Ethical and reputational due diligence is a critical component of WaterAid’s organisational strategy. Before, WaterAid’s ethical check process consisted of either in-house manual checks (which could be time-consuming) or externally commissioned checks by consultants (which can be costly), and ultimately have a knock-on effect on capacity and productivity.

With Xapien, WaterAid has been able to transform its ethical due diligence process. Xapien is primarily used to conduct ethical checks relevant to WaterAid’s line of work, focusing on understanding potential risks associated with engaging new donors, partners, or suppliers, and identifying opportunities from these relationships. Xapien enables WaterAid to conduct a full, in-depth ethical assessment.

Customer stories

WaterAid

KCL turned to Xapien to assess around 200 new partnership opportunities per year, protecting the £3.5 million in research activity it conducts with partners annually. Gathering information about potential partners or collaborators used to take the team about a day. This manual approach not only consumed valuable time but also risked leaving information gaps.

The team now uses Xapien to gather key information on potential research collaborators at the application stage, which is fundamental to the UKRI’s updated terms. If red flags appear, KCL can address them early, avoiding later scrutiny from the UKRI. Running a Xapien report takes only 3 to 4 minutes on average, and reviewing the report typically takes about an hour, depending on the complexity of the collaborator's profile.

Customer stories

King's College London

Cytora integrated with Xapien to enable commercial insurance underwriters to instantly gain access to our AI-powered due diligence via Cytora’s risk processing platform. By integrating directly into Cytora, underwriters no longer need to manually check scores of data sources for potential risks.

Our AI-powered tool automatically reads and analyses information such as online media, corporate records and structured screening data in any language. As a result, the time taken for due diligence can be reduced from hours or days to minutes. Access to rapid, automated due diligence reports on all their policyholders will fight commercial claims fraud, and facilitate more informed forecasting.

Customer stories

Cytora

Griffin is creating the bank you can build on with an API-first, full-stack Banking as a Service platform. Compliance is a key offering so it’s vital that Griffin upholds industry best practices in its own third party risk management. It used to take at least a day to perform due diligence on every prospect, or supplier. This held back business growth.

Thanks to Xapien, enhanced due diligence on the directors of prospect companies and suppliers have gone from a resource-intensive one-day process to detailed evidence-based reports in under 12 minutes. The insights provided by the compliance team are shared with sales teams within hours, not days, so Griffin can get on with building a rapidly scaling business.

Customer Stories

Griffin

The University would conduct extensive prospect research and cultivate the relationship until a certain point where they would ask for a gift. At that stage, if something adverse came up in due diligence it could create a complicated situation for the fundraisers to unwind. Moreover, they’d already invested a large amount of time and effort into a gift they’d then have to turn down.

Xapien optimised the operations team's process by building due diligence into prospect research from the start. Instead of spending hours on manual research, Xapien surfaces all relevant information about a prospect in minutes. This means due diligence can be done upfront without holding up the prospect research process. By combining the two processes early on, it helps the fundraising team focus their efforts on which prospects to approach for donations.

Customer stories

University of Liverpool

The development team’s due diligence process involved a template with specific information requirements. Each team member would manually search for this information online, which meant carefully researching and reviewing news articles, Wikipedia, and company websites one by one, before analysing and summarising the findings.

This was time-consuming, taking half or day—or sometimes an entire day—to compile a report to the expected standard. There was also the risk of human error. Individuals might overlook critical details, leading to variations in quality depending on who was doing the research. This lack of uniformity made sharing the information with senior leadership a challenging task.

Customer stories

Royal Air Force Museum

The Operations team had one Research Assistant carrying out the entirety of their prospect research, which carried a lot of unnecessary risk. While great at finding information, the researcher didn’t have enough experience to interpret and assess various risks and there was a risk they might something. The research process was also entirely manual, which was time-consuming and, in some cases, patchy. The researcher would end up spending most of the time looking up information on databases and search engines, and then writing up the results, leaving little time for analysis and interpretation.

Xapien alleviated all these risks by automating the fact finding. Now, Paula and her team spend more time interpreting the risks that Xapien surfaces and categorises rather than collating the findings. They’ve gone from 4 to 5 hours of reading hundreds of articles online to running a comprehensive report in 15 minutes. Paula’s team can deliver value to the rest of the organisation by adding strategic advice on top of their insights. They stopped wasting time on less problematic cases at the outset and instead prioritised risky subjects and developed strategies for how the University could deal with them.

Customer stories

Newcastle University

The Prospect Research Manager, being the sole researcher at Sightsavers, is responsible for all research and due diligence checks. This research, whether it’s a quick review or in-depth investigation, would often take a couple of hours to an entire day or even longer. In turn this this would cause delays to fundraisers being able to commence stewardship and delays in the delivery of bespoke research projects.

Integrating Xapien into the workflow has proven to be a game changer for the Prospect Research Manager, enabling them to handle multiple research and due diligence requests with remarkable efficiency and speed.

Xapien has become an indispensable research tool eliminating the need to dedicate entire days to due diligence research. This has resulted in quicker approval and grant processes and fostered better relationships with potential donors.

Customer stories

Sightsavers

The Museum of London has a small team of three who manage the entire advancement practice and only one person who is responsible for their entire research function. The Museum does not have a large existing pool of donors that they can leverage. They needed to scale the fundraising efforts rapidly, with limited resources.

Ciara FitzGerald-Graham, the Museum's Fundraising Intelligence Manager, adopted Xapien for her research and due diligence. With Xapien's AI-generated reports, she gets comprehensive due diligence results in minutes, not days. This saves her time and lets her focus on prospecting and scaling their fundraising efforts.

Bonus: Running a Xapien report provides the team with an extra layer of security that all risks have been checked, protecting the organisation from reputational risk.

Customer stories

Museum of London

Hopehead were using a variety of databases and tools for their due diligence process, but their team had to manually search the open web to piece together a picture of an individual or organisation. It was a time-consuming and challenging process, and there was always the risk they might miss something.

With Xapien's on-demand research tool, Hopehead are confident they've thoroughly searched through every relevant piece of information on the open web. What used to take up to 4 hours now takes around 30 minutes, with an additional 10 minutes to review and extract relevant information for the final report.

Bonus: Xapien adds an extra level of assurance to Hopehead’s scoping process, enabling them to send out client proposals quickly and efficiently.

Customer stories

Hopehead

The research team endeavours to dedicate as much time to proactive research—finding new prospects and exploring emerging leads—as they do to reactive research, which involves investigating existing individuals in the pipeline. However, with over 20 fundraisers to support, achieving this balance is a challenge – more time is spent responding to reactive fundraiser requests than carrying out new-name identification, which limits the organisation’s ability to expand into new areas.

With Xapien, the information that would sometimes take the research team up to half a day to uncover through desk research can now be found in just 10 minutes. This timesaving enables research profiles to be written and delivered in half the time, freeing up researchers to engage in proactive research.

Customer stories

The University of Manchester

Given the scale of the team’s operations, they have always relied on technology to support them. Before Xapien, the firm used a different tool which would often result in more manual work than it saved. They would receive lengthy PDF reports that lacked interactivity and tended to produce false hits. The team had to sift through page after page, determining whether the information was relevant to the targeted companies and individuals. These reports typically spanned nearly 50 pages and made it challenging to discern what the direct risks were. The result was a slow process and a difficult relationship with the first line.

The firm now uses Xapien to screen portfolio companies they plan to buy. The Xapien reports take 10 minutes to run and provide early insights on risks and red flags as well as highlighting complex corporate structures. This allows the compliance team to quickly confirm if a portfolio company is suitable for a deal, and get back to the first line far quicker. They are no longer responsible for holding up the deal due to extensive background research, but can provide rapid insights early on in the cycle allowing the deal team to make more efficient decisions.

Customer stories

Leading private equity firm

The General Counsel at Pinsent Masons recognised that digitisation was essential for the compliance team to conduct due diligence earlier in the onboarding phase in a way that better balances resources. However, the firm faced challenges in finding a tool that was both reliable and trustworthy. This led them to partner with us to co-develop the legal market’s first AML due diligence tool powered by a Large Language Model (LLM).

When integrated into the process, the firm expects low-risk clients to be cleared in hours as opposed to days. Rather than spreading their focus equally across all clients, Xapien will enable its analysts to allocate resources more effectively to higher-risk cases, applying the appropriate level of AML controls to each client and focused ongoing monitoring.

Customer stories

Pinsent Masons

Zurich conducts thorough investigations on Commercial Companies as part of their operations. The process involves collecting data from multiple records to validate policy responses and ensure accurate risk assessments. This used to be a time-consuming, labour-intensive process.

With Xapien’s AI-powered technology, Zurich’s claims investigations team gather comprehensive corporate information about individuals in 10 minutes. Zurich uses these reports to make quick, confident decisions about all investigation subjects, protecting the institution from risk.

Customer Stories

Zurich Insurance

Dartmouth initially adopted Xapien to support its existing reputational risk research methods. However, Xapien quickly replaced many traditional tools and methodologies. Xapien not only formed part of a robust reputational risk process but also centralised the function across the university.

The ability to perform due diligence and produce comprehensive reports at scale has allowed the team to clear a backlog of donors awaiting checks before this process was fully implemented. In addition to this, Xapien enables due diligence to be done at an earlier stage on prospects.

Customer Stories

Dartmouth College

Dow Jones’s Risk & Compliance team recognised a growing need for deep and broad due diligence on an increasing number of counterparties. But clients also needed their programs to be cost-effective while delivering results fast. Dow Jones wanted to transform the due diligence process for its clients.

By partnering with Xapien, they reduced the time needed to run a background check from days to minutes. The combination of Xapien’s groundbreaking AI and Dow Jones’s world-leading data set is reshaping risk management workflows, creating an additional layer of investigation that can be deployed at scale.

Customer stories

Dow Jones Risk & Compliance

The donor due diligence process involves different teams collaborating. First, the prospect research team delves into a prospect's background, while the fundraising team examines and sends requests for additional investigation. Afterwards, the due diligence team carries out a personalised background check and risk assessment, which can take up to two days. But the real challenge starts when concerns arise after a relationship has been established. At that point, a significant amount of resources has already been invested in the process.

Xapien's automated background reports provide a full picture of any person or organisation, anywhere in the world, in 5 to 10 minutes. The platform reads and analyses data from across the internet to deliver consolidated, insightful reports including flagged risks, wealth estimates, assets, and associates. By integrating due diligence with prospect research, the two processes work hand in hand instead of holding each other back. Armed with this knowledge, Cambridge University can confidently move forward with fundraising, knowing they have a solid understanding of their prospects.

Customer stories

University of Cambridge

Ethical and reputational due diligence is a critical component of WaterAid’s organisational strategy. Before, WaterAid’s ethical check process consisted of either in-house manual checks (which could be time-consuming) or externally commissioned checks by consultants (which can be costly), and ultimately have a knock-on effect on capacity and productivity.

With Xapien, WaterAid has been able to transform its ethical due diligence process. Xapien is primarily used to conduct ethical checks relevant to WaterAid’s line of work, focusing on understanding potential risks associated with engaging new donors, partners, or suppliers, and identifying opportunities from these relationships. Xapien enables WaterAid to conduct a full, in-depth ethical assessment.

Customer stories

WaterAid

KCL turned to Xapien to assess around 200 new partnership opportunities per year, protecting the £3.5 million in research activity it conducts with partners annually. Gathering information about potential partners or collaborators used to take the team about a day. This manual approach not only consumed valuable time but also risked leaving information gaps.

The team now uses Xapien to gather key information on potential research collaborators at the application stage, which is fundamental to the UKRI’s updated terms. If red flags appear, KCL can address them early, avoiding later scrutiny from the UKRI. Running a Xapien report takes only 3 to 4 minutes on average, and reviewing the report typically takes about an hour, depending on the complexity of the collaborator's profile.

Customer stories

King's College London

Cytora integrated with Xapien to enable commercial insurance underwriters to instantly gain access to our AI-powered due diligence via Cytora’s risk processing platform. By integrating directly into Cytora, underwriters no longer need to manually check scores of data sources for potential risks.

Our AI-powered tool automatically reads and analyses information such as online media, corporate records and structured screening data in any language. As a result, the time taken for due diligence can be reduced from hours or days to minutes. Access to rapid, automated due diligence reports on all their policyholders will fight commercial claims fraud, and facilitate more informed forecasting.

Customer stories

Cytora

Griffin is creating the bank you can build on with an API-first, full-stack Banking as a Service platform. Compliance is a key offering so it’s vital that Griffin upholds industry best practices in its own third party risk management. It used to take at least a day to perform due diligence on every prospect, or supplier. This held back business growth.

Thanks to Xapien, enhanced due diligence on the directors of prospect companies and suppliers have gone from a resource-intensive one-day process to detailed evidence-based reports in under 12 minutes. The insights provided by the compliance team are shared with sales teams within hours, not days, so Griffin can get on with building a rapidly scaling business.

Customer Stories

Griffin

Our Customers

What our customers say

"Xapien is our first line of defence. Our compliance team can ensure deals proceed without delays."

Leading private equity firm

"Xapien saves a huge amount of time, which allows me to focus on prospecting."

“We all sleep better at night knowing that with Xapien, we carried out due diligence in a very comprehensive way.”

"This year alone the reports generated by Xapien have easily saved me a month of desk-based research".

"Xapien effectively filters out false positives and provides high-quality information. It's a valuable tool for analysts."

"Xapien saves a huge amount of time, which allows me to focus on prospecting."

“Xapien does in eight minutes what would take a manual researcher eight hours.”

“Xapien enables Provenir to deliver a whole new layer of digitisation into the customer onboarding process.“

“Together with Xapien, we are pioneering the future of risk mitigation.”

“Xapien is a very dynamic catalyst for getting to where I want to go.”

“Seeing the product was a Eureka moment for us.”

"Xapien is our first line of defence. Our compliance team can ensure deals proceed without delays."

Leading private equity firm

"Xapien saves a huge amount of time, which allows me to focus on prospecting."

“We all sleep better at night knowing that with Xapien, we carried out due diligence in a very comprehensive way.”

"This year alone the reports generated by Xapien have easily saved me a month of desk-based research".

"Xapien effectively filters out false positives and provides high-quality information. It's a valuable tool for analysts."

"Xapien saves a huge amount of time, which allows me to focus on prospecting."

“Xapien does in eight minutes what would take a manual researcher eight hours.”

“Xapien enables Provenir to deliver a whole new layer of digitisation into the customer onboarding process.“

“Together with Xapien, we are pioneering the future of risk mitigation.”

“Xapien is a very dynamic catalyst for getting to where I want to go.”

“Seeing the product was a Eureka moment for us.”

"Xapien is our first line of defence. Our compliance team can ensure deals proceed without delays."

Leading private equity firm

Cytora

Cytora

Cytora

Cytora

Cytora

Cytora

Cytora

Cytora

Cytora

Pricing FAQs

How much does Xapien cost?

Xapien is a subscription service with pricing packages based on team size. Just get in touch with one of our sales team to learn more. NB: we do not offer one-off reports or consulting services.

What data do you have?

Xapien isn't a data company (we get asked this quite a bit). We’re an AI company that searches, reads, and researches open source content from the entire indexed internet to provide comprehensive background research reports on individuals and organisations. We do integrate 0.5bn corporate records from international corporate registries, and data from leading pep/sanctions/watchlists screening providers, but we do so much more than that. We analyse and consolidate data from 35 trillion website pages - the entire indexed internet

Are there any integration costs?

Zero. Every team and department can perform powerful background investigations regardless of location. All you need is a laptop, Wi-Fi and off you go.

How are you different to ChatGPT?

Generative AI technology alone can’t be used for due diligence. Xapien is designed for due diligence professionals. It researches and triangulates across structured data such as sanctions lists and unstructured data from the entire indexed internet. Data verification is built into the product through our multi-source approach. Our cutting-edge anti-hallucination technology adds a final layer to the reliability.

What's the difference between individual and company reports?

Nothing. Our subscription model doesn’t distinguish between company and people reports—each counts as a single report.

How quickly can we get set up

Immediately. We pride ourselves on our ease of integration with any existing process. Xapien is accessed via the web. Users will receive a URL with a link to the login portal, which they can access from any browser. Simply enter a password and you’re up and running. You’ll be able to run Xapien reports using your account and export or share them with other people in your team.

Get started

Step 1

Schedule a 30-minute call to view Xapien in action and discuss your needs with a consultant.

Step 2

Decide on the right subscription for you. Whether you're a small organisation or an established enterprise, we scale with you.

Step 3

Log into Xapien from any browser and get started. Count on continuous support from our customer service team.

Step 4

Share Xapien’s fully-sourced, auditable, written reports with colleagues, customers and regulators alike.

Xapien streamlines due diligence

Xapien's AI-powered research and due diligence tool goes faster than manual research and beyond traditional database checks. Fill in the form to the right to book in a 30 minute live demonstration.